Both Donchian Channels and Moving Averages are popular tools for traders—but they serve different purposes and work best under different market conditions. Choosing between them (or combining them) depends on your trading goals.

In this article, we’ll compare Donchian Channel vs Moving Averages, explore their strengths and weaknesses, and help you decide which fits your trading strategy best.

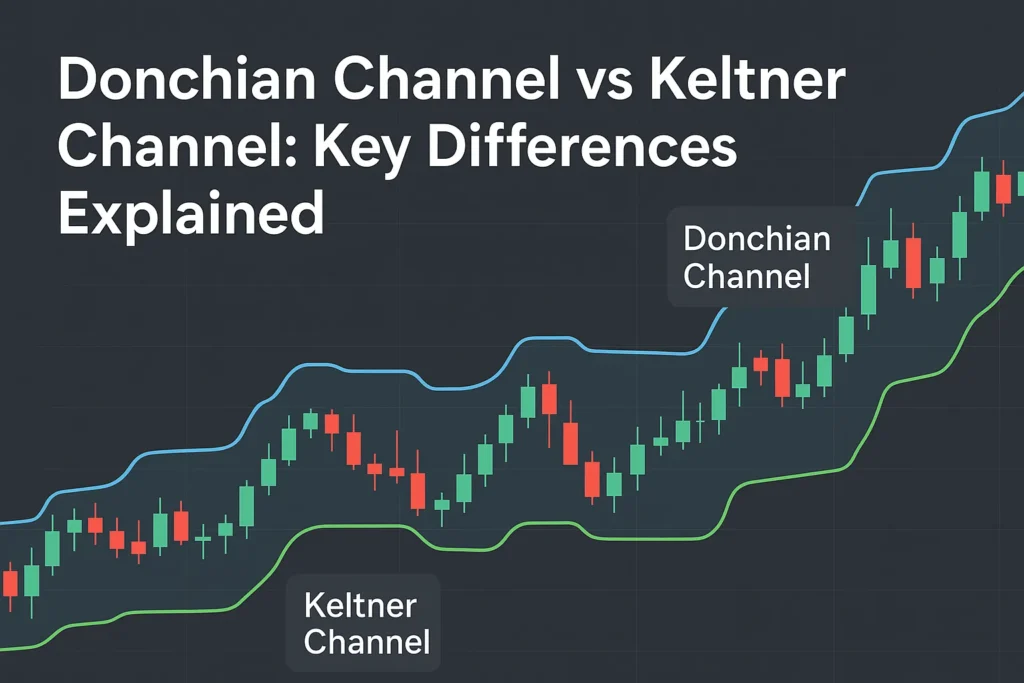

What Is the Donchian Channel?

The Donchian Channel plots:

- Upper Band: Highest high over the last N periods

- Lower Band: Lowest low over the last N periods

- Middle Band (optional): Average of upper and lower bands

Best for: Breakout and trend-following strategies.

What Are Moving Averages?

Moving Averages (MAs) smooth out price data to identify trend direction.

- Simple Moving Average (SMA): Equal weighting across periods

- Exponential Moving Average (EMA): More weight to recent prices

Best for: Trend confirmation, dynamic support/resistance, crossover strategies.

Donchian Channel vs Moving Averages: Quick Comparison

| Feature | Donchian Channel | Moving Averages |

|---|---|---|

| Signal Type | Breakouts (high/low range) | Trend smoothing |

| Use Case | Entry/Exit on breakouts | Trend direction, dynamic levels |

| Lag | Less lag (reacts to highs/lows) | More lag (averages past prices) |

| Visual Clarity | Channel structure (high/low boundaries) | Single-line curves |

| Ideal Market Type | Trending or breakout markets | Trending and mean-reverting markets |

| Stop-Loss/Exit | Opposite band | Support/resistance at MAs |

When to Use Donchian Channel

- You trade breakouts

- You prefer clear entry and stop-loss levels

- You want to follow price extremes rather than averages

Example: Buy when price closes above the upper band of a 20-day Donchian Channel.

When to Use Moving Averages

- You want to identify trend direction

- You use crossovers to signal entries (e.g., 50 EMA crosses 200 EMA)

- You like smoother signals with less noise

Example: Price pulls back to the 50 EMA in an uptrend → long opportunity.

Can You Combine Them?

Yes! This is actually a powerful combo.

Example Strategy:

- Donchian Channel gives breakout entry

- Moving Average filters trades (only buy if price is above 50 EMA)

This improves signal quality and reduces false breakouts.

Which Works Better?

There’s no universal winner—it depends on your style.

| If you want… | Use… |

|---|---|

| Clear breakout entries | Donchian Channel |

| Smooth trend-following with less noise | Moving Averages |

| Easy stop-loss and exit planning | Donchian Channel |

| Trend filtering and confirmation | Moving Averages |

Conclusion

Both Donchian Channels and Moving Averages are useful tools in a trader’s toolkit. If you prefer breakout-style trading, Donchian Channels offer clearer signals and defined stop levels. If you lean toward trend-following or swing trading, Moving Averages provide excellent guidance on direction and support zones.

Use them separately or combine them to build a more reliable, rules-based strategy.

FAQs

Q1: Which is better for day trading—Donchian Channel or MA?

Donchian Channels give faster breakout signals. MAs offer trend context. Use both for balance.

Q2: Can I use a Donchian Channel with a 200 EMA?

Yes. Many traders only take Donchian breakouts when price is above the 200 EMA.

Q3: Do Donchian Channels lag less than moving averages?

Yes. Donchian responds directly to price extremes, not averages.

Q4: Which is better in a range-bound market?

Moving Averages may work better for mean-reversion setups.

Q5: Should I backtest both before choosing?

Absolutely. Test on your preferred asset and timeframe to see what works best.