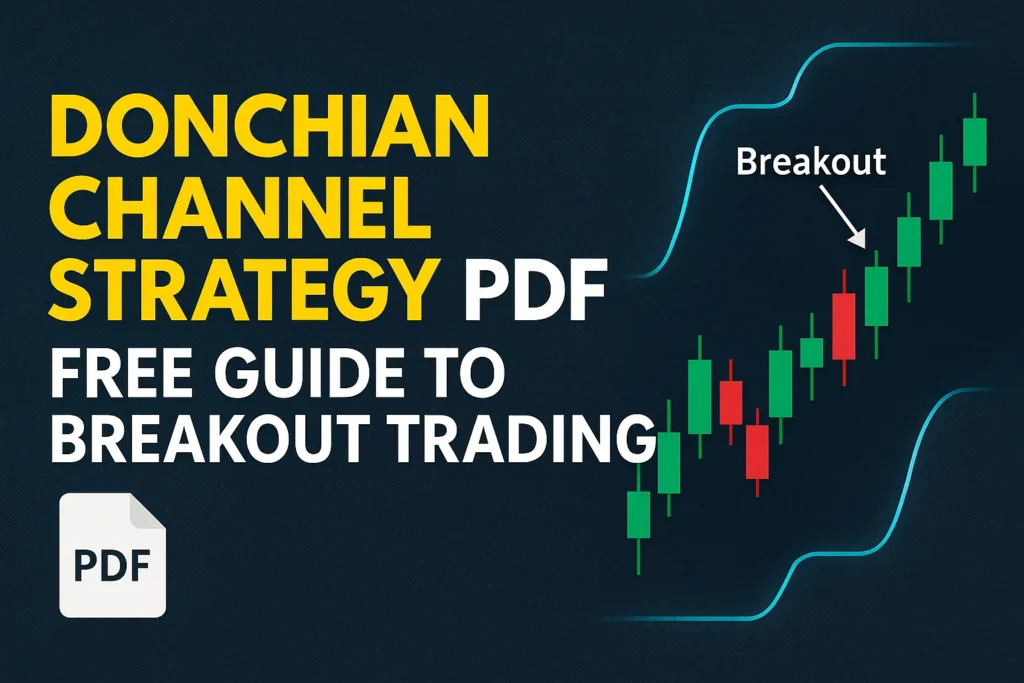

The Donchian Channel isn’t just an indicator—it’s a complete system for spotting breakouts and riding trends. If you’re a beginner trader looking to explore powerful and easy-to-follow strategies, this guide is for you.

Below are five practical Donchian Channel trading strategies used across stocks, forex, and crypto markets. Each one includes simple rules and helpful tips to get started right away.

1. Classic 20-Day Breakout Strategy

This is the original Donchian Channel strategy made popular by Richard Donchian and later used in the legendary Turtle Trading system.

Rules:

- Buy when price breaks above the 20-day high (upper band)

- Sell when price breaks below the 20-day low (lower band)

- Exit when price closes back inside the channel

Best for: Trending markets

Tip: Add volume confirmation to avoid false breakouts.

2. Double Donchian Strategy

This strategy uses two Donchian Channels with different lengths to filter entries and reduce noise.

Setup:

- Use a short-term channel (e.g., 10 periods)

- Overlay a long-term channel (e.g., 50 periods)

Rules:

- Buy when price is above both channels

- Sell when price is below both

Best for: Confirming trend strength

Tip: Helps avoid whipsaws during consolidations.

3. Donchian + Moving Average Filter

Combining Donchian with a moving average helps you avoid trades against the trend.

Rules:

- Add a 50-period Moving Average

- Buy breakouts only when price is above the MA

- Sell breakdowns only when price is below the MA

Best for: Trend direction filtering

Tip: Use this method in conjunction with the 20-day Donchian Channel.

4. Donchian Channel Pullback Strategy

Sometimes the best entries come after the breakout. This strategy waits for a pullback to the mid-band.

Rules:

- Wait for breakout above the upper band

- Enter on pullback to the middle band (average of high and low)

- Use lower band as stop-loss

Best for: Reducing risk after initial move

Tip: Look for bullish candlestick patterns at the pullback area.

5. Short-Term Donchian Reversal Strategy

In range-bound markets, Donchian can signal short-term reversals at channel extremes.

Rules:

- Buy near the lower band if the price shows rejection

- Sell near the upper band if the price stalls or shows resistance

- Confirm with RSI or MACD

Best for: Range markets, scalping

Tip: Avoid during strong trending conditions.

How to Choose the Right Strategy

Each strategy suits a different market condition. Beginners should test each one in a demo account before trading live.

| Market Condition | Best Strategy |

|---|---|

| Trending | Classic Breakout or Double Channel |

| Sideways/Range | Reversal Strategy |

| Volatile | MA Filter or Pullback Strategy |

Risk Management Tips

- Always use a stop-loss (e.g., opposite band or recent swing low/high)

- Don’t risk more than 1–2% of your capital per trade

- Use position sizing based on trade setup

Conclusion

The Donchian Channel trading strategies covered here are simple yet powerful. Whether you’re trading stocks, forex, or crypto, these methods help you identify trends, manage risk, and build discipline.

Choose one strategy, test it, and master it before exploring more.

FAQs

Q1: Which Donchian Channel strategy is best for beginners?

The classic 20-day breakout strategy is simple and effective for trending markets.

Q2: Can I use these strategies for intraday trading?

Yes, especially the pullback and reversal strategies on 5-min to 1-hour charts.

Q3: Should I combine Donchian with other indicators?

Yes. Moving averages, RSI, or MACD can improve signal quality.

Q4: What is the success rate of Donchian strategies?

Success depends on market conditions and discipline. No strategy works 100% of the time.

Q5: How do I backtest these strategies?

Use platforms like TradingView, MT4, or Thinkorswim to manually or automatically backtest setups.